UTAH MEDICAL PRODUCTS (UTMD)·Q4 2025 Earnings Summary

Utah Medical Products Q4 2025: Revenue Drops as Key Customers Exit, But Cash Piles Up

January 29, 2026 · by Fintool AI Agent

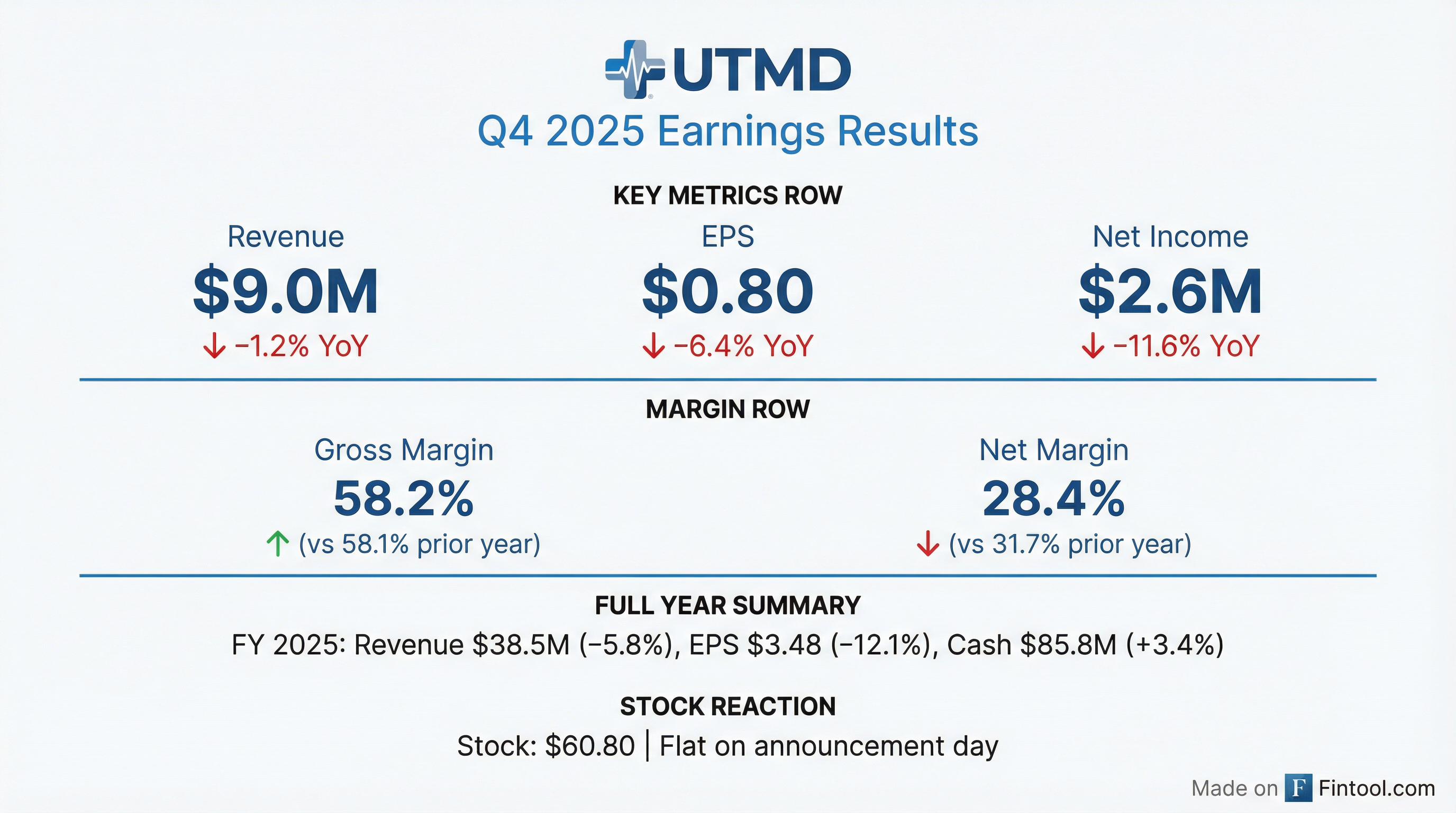

Utah Medical Products reported Q4 2025 results that tell a story of a company navigating customer losses while protecting its exceptional cash generation. Revenue declined 1.2% year-over-year to $9.04 million, and diluted EPS fell 6.4% to $0.80 — but gross margins actually ticked up, and the company ended the year with $85.8 million in cash despite returning $12.4 million to shareholders through buybacks and dividends.

For full-year 2025, the picture is starker: revenue dropped 5.8% to $38.5 million, and net income fell 18.7% to $11.3 million. The culprit? A near-total collapse in two customer relationships that accounted for essentially all the decline.

Did UTMD Beat Earnings?

No analyst coverage exists for this ~$200M market cap medical device company, so there's no consensus to beat. However, compared to management's own beginning-of-year projections, the company acknowledged it "did not achieve its beginning of year financial projections" due to "unexpected circumstances."

Here's how Q4 2025 stacked up against Q4 2024:

The smaller EPS decline (-6.4%) versus net income decline (-11.6%) is due to aggressive share repurchases — UTMD bought back 4.5% of its shares during 2025.

What Drove the Revenue Decline?

Three categories explain nearly the entire $2.4M full-year revenue decline:

The PendoTECH collapse: This biopharma OEM customer accounted for 85% of the expected sales decline. Sales to PendoTECH went from $2.7M in 2024 to just $0.4M in 2025.

The China surprise: UTMD's China distributor placed a "non-changeable/noncancellable" order at the start of 2025 — then surprisingly cancelled it in Q3. This resulted in $431K lower revenue than committed, plus a $395K bad debt write-off for cancellation fees the distributor never paid.

Filshie device divergence: Domestic U.S. Filshie sales were actually +11% ($4.5M vs $4.0M), but OUS direct and distributor sales collapsed -16% and -23% respectively.

How Are Margins Holding Up?

Despite the revenue pressure, UTMD's margin story shows resilience:

The Q4 gross margin actually improved slightly year-over-year, partly because the low-margin China distributor business was absent from both periods. Full-year gross margin compression was "squeezed by supplier costs for raw materials continuing to increase and further employee cost-of-living adjustments, thanks to the residual inflationary effects of excessive government largesse during and after the COVID pandemic."

Operating margin took a bigger hit due to unusual G&A expenses: the $395K China cancellation write-off, a $195K embezzlement loss from UTMD's Australian subsidiary manager (who "pled guilty, but hasn't repaid"), and FX impacts from a stronger EUR/GBP.

What Changed From Last Quarter?

Q4 vs Q3 2025 sequential comparison:

The sequential revenue drop reflects continued pressure from the lost China business and OUS Filshie weakness. However, gross margin improved 110 basis points quarter-over-quarter, and the tax rate was favorable (17.4% vs ~20% for the year).

What Did Management Guide?

Management provided qualitative rather than quantitative guidance for 2026:

Headwinds baked in:

- OEM sales to PendoTech: Expected to be ZERO (vs $0.4M in 2025)

- Blood pressure monitoring kits to China: Expected to be ZERO (vs $2.1M combined in 2025)

- Total known revenue loss: ~$2.5M already built into base case

How they plan to offset:

- New product sales (including to other biopharma customers)

- Modest organic growth in existing business

- Continued domestic Filshie device growth

- Improvement in OUS Filshie device sales

Management caveat: "with substantial uncertainty"

What About the Balance Sheet?

This is where UTMD shines. Despite a challenging year, the company's financial position strengthened:

UTMD generated enough operating cash flow to:

- Pay $8.4M in share buybacks (148,935 shares at ~$56.10 avg)

- Pay $4.0M in dividends ($1.22/share for the year)

- Still grow cash by $2.8M

The dividend was just increased to $0.31/quarter starting January 2026 (vs $0.305 in Q4 2025).

How Did the Stock React?

The stock was essentially flat on the announcement day:

The muted reaction suggests the market had already priced in the revenue headwinds. UTMD stock is up nearly 9% year-to-date after falling 9% in 2025. Management noted that 2025 "marks the first time over the last 27 years that UTMD's stock price declined three years in a row."

What Should Investors Watch?

Near-term catalysts:

- 2025 10-K filing (expected by March 27, 2026)

- New product launches (validation testing underway, per increased Q4 R&D)

- OUS Filshie device sales stabilization

Key risks:

- Litigation: 14 of 19 Filshie clip product liability lawsuits dismissed, 4 awaiting court decisions. "Any cases that must go to trial could drive up litigation expenses significantly."

- Customer concentration: The PendoTECH and China exits show vulnerability to single-customer exposure

- FX headwinds: Stronger GBP/EUR hurt operating expenses; management assumes flat FX for 2026 projections

The bull case: This is a cash-generating machine (45%+ adjusted EBITDA margins) trading at less than 2.5x cash with no debt, buying back stock, raising dividends, and still growing its cash pile despite customer losses.

The bear case: Revenue has now declined four consecutive years (from $52.3M in 2022 to $38.5M in 2025), with another $2.5M headwind baked into 2026. At some point, shrinking top-line catches up even to the best capital allocators.

Key Takeaways

- Revenue declined but was manageable: -1.2% Q4, -5.8% full year, driven by known customer losses (PendoTECH, China)

- Margins held steady: Q4 gross margin ticked up; operating margin pressured by one-time items

- Cash generation remains strong: $85.8M in cash (+$2.8M) despite $12.4M returned to shareholders

- 2026 headwinds quantified: ~$2.5M in lost revenue already expected (PendoTECH + China = zero)

- Shareholder returns continue: Dividend raised to $0.31/quarter, aggressive buybacks ongoing

For more details, see the full 8-K filing or explore UTMD's research page.